23.01.2024

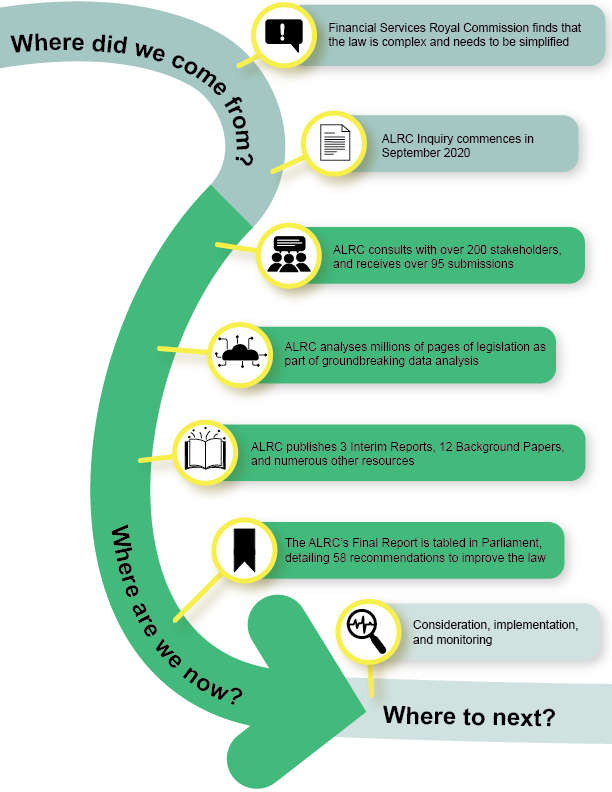

Last week, the Final Report of the ALRC’s Corporations and Financial Services Inquiry was published. The Final Report laid out the results of three years’ work examining why the law is so complex and setting out how it should be reformed. In this article, we describe the ALRC’s journey from the Inquiry’s genesis through to next steps.

This is the first in a series of short articles following the release of the Final Report. Each piece aims to give a simple overview of the ALRC’s recommendations and important themes from the inquiry.

Where did we come from?

In 2019, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (also known as the Hayne Royal Commission) found that corporations and financial services legislation is overly complex and in need of simplification. In particular, the Royal Commission found that financial services legislation fails to communicate the fundamental norms of behaviour that it promotes.

Against this background, the Australian Government gave the ALRC Terms of Reference, which tasked the ALRC with making financial services and corporations legislation clearer and more understandable.

The ALRC’s analysis confirms that corporations and financial services legislation remains unnecessarily complex. The main sources of unnecessary complexity include:

- an incoherent legislative hierarchy;

- poorly designed primary and delegated legislation;

- issues with law-making processes and legislative maintenance;

- extensive use of notional amendments; and

- proliferating powers and instruments creating a legislative maze.

See Chapter 2 of the Final Report for more details.

Where are we now?

The ALRC consulted with a wide variety of stakeholders, including regulators, government departments, academics, legal professionals, and industry representative bodies. Stakeholders were given the opportunity to provide feedback and formal submissions in response to the ALRC’s preliminary proposals throughout the Inquiry. Stakeholders almost universally agreed with the ALRC that the existing legislation is complex and that it should be simplified.

The ALRC also produced groundbreaking new empirical data analysis, providing fresh insights into the causes and consequences of legislative complexity. The ALRC’s empirical analysis confirmed stakeholders’ anecdotal experience of complexity. Further detail about the ALRC’s data analysis is available on the ALRC Data Hub.

Throughout the Inquiry, the ALRC published 12 Background Papers, and three Interim Reports.

The ALRC has now published its Final Report, which contains 58 recommendations for reform (23 of these recommendations were made in the three Interim Reports). These recommendations aim to simplify and rationalise corporations and financial services legislation, making it easier to use and understand.

Where to next?

Now that the Final Report has been published, the Australian Government will consider which of the ALRC’s recommendations should be implemented. Several recommendations made by the ALRC in Interim Reports A and B have already been implemented.

Chapter 7 of the Final Report sets out a staged process for implementing many of the recommendations. This staged process categorises the recommendations into six ‘Pillars’. See Chapter 7 of the Final Report for more details.

The ALRC has also recommended several measures to ensure that the recommendations have an enduring effect into the future. This includes the creation of guidance for legislative drafting, and a legislative data framework to monitor the development of corporations and financial services legislation.