01.02.2024

Throughout the Corporations and Financial Services Legislation Inquiry, stakeholders emphasised the importance of staging the implementation of reforms and managing transition costs. This article explains the ALRC’s suggested approach for implementing the reformed legislative framework for financial services.

This is the fourth in a series of short pieces following the release of the ALRC’s Final Report relating to the legislative framework for corporations and financial services regulation. In an earlier article, we outlined the reformed framework and explained how users would navigate it.

Why devote a whole chapter of the Final Report to Implementation?

Implementing reform comes with challenges and risks, such as transition costs and a risk that the job is left only half done. Chapter 7 of the Final Report details the ALRC’s approach to implementation and explains how the reformed legislative framework could be implemented in a logical, staged way so as to realise the benefits of reform as early as possible, minimise transition costs, and reduce the risk of it being left incomplete.

In summary, the ALRC’s suggested approach has two main elements:

- a Reform Roadmap (which sets out six Reform Pillars to guide implementation); and

- Steps to Implementation (which detail how each Reform Pillar should be approached).

The Reform Roadmap and the Six Reform Pillars

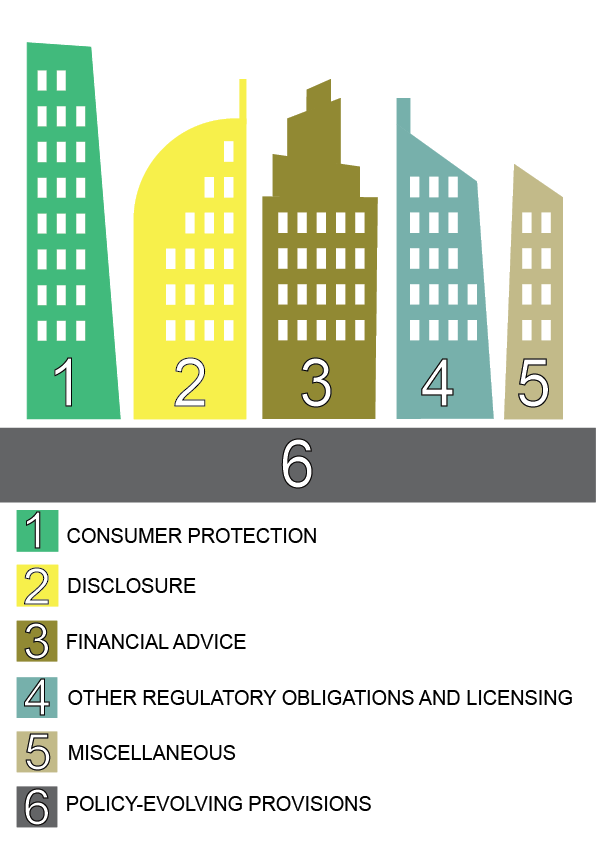

The ALRC’s approach to implementing the reformed legislative framework is built on six Reform Pillars, shown in the following diagram:

The order of the Pillars is important. The Reform Roadmap is structured to realise the benefits of reform as early as possible.

- Pillar One (Consumer Protection) lays the foundation for future reforms. It does this by ensuring the legislation better communicates fundamental norms and frames the more specific obligations in later pillars.

- Pillar Two (Disclosure) would have a significant impact on reducing unnecessary complexity, with benefits for regulated persons, consumers, and investors.

- Pillar Three (Financial Advice) would bring together and consolidate the currently disparate provisions relating to financial advice, helping to reduce the costs of advice, support advisers to understand their obligations, and promote higher quality advice.

- Pillar Four (Other Regulatory Obligations and Licensing) would simplify the myriad regulatory obligations of financial services providers, and would complete the process of establishing a more navigable and comprehensible legislative framework.

- Pillar Five (Miscellaneous) would deal with reforms that are not captured by other pillars.

- Pillar Six (Policy-Evolving Provisions) provides a means of accommodating policy developments and policy reform alongside creation of the reformed legislative framework.

The ALRC recommends that the Reform Roadmap and implementation process be overseen by a specifically resourced taskforce (or taskforces) dedicated to that task (Recommendation 54). Taskforces are often used to implement reforms, drawing on expertise both within and outside government. Utilising a taskforce to implement reforms is an important way of minimising the challenges that confront any reform project.

Further detail about each of the Reform Pillars and taskforces is contained in Chapter 7 of the Final Report.

Steps to Implementation

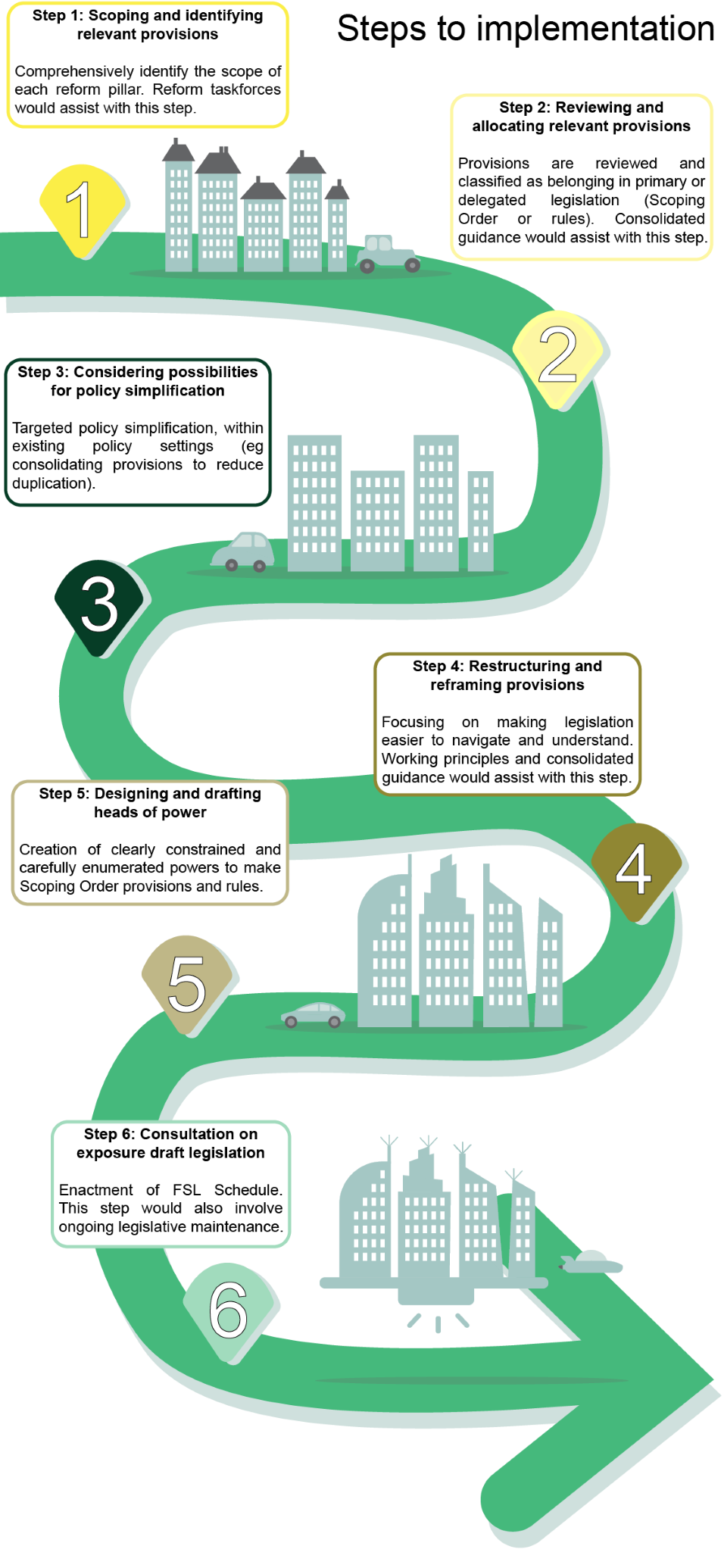

Each Reform Pillar in the Roadmap would be implemented by following the six steps set out below:

In summary, the Steps to Implementation would involve:

- developing a clear understanding of the existing legislative framework and the design of the reformed legislative framework (Steps 1 and 2);

- looking at the bigger picture, to identify instances where targeted policy simplification could complement technical reforms to reduce legislative complexity (Step 3);

- applying best-practice principles of legislative design when preparing the legislation that implements the reformed legislative framework (Steps 4 and 5); and

- ensuring the reformed legislative framework is maintained into the future (Step 6), which should include periodic post-enactment review (Recommendation 55).

Chapter 7 of the Final Report contains further detail about the implementation process and explains the importance of ongoing legislative maintenance.