25.01.2024

The existing legislative framework for financial services is unnecessarily complex and difficult to use. So how should it be improved?

This article briefly explores the reformed legislative framework for financial services legislation recommended by the ALRC in the Final Report of the Corporations and Financial Services Legislation Inquiry. It also illustrates the benefits of the reformed legislative framework by showing how it would be much simpler to navigate than the existing legislative framework.

This is the second article in a series of short pieces following the release of the ALRC’s Final Report. Revisit the first article here.

The existing legislative framework

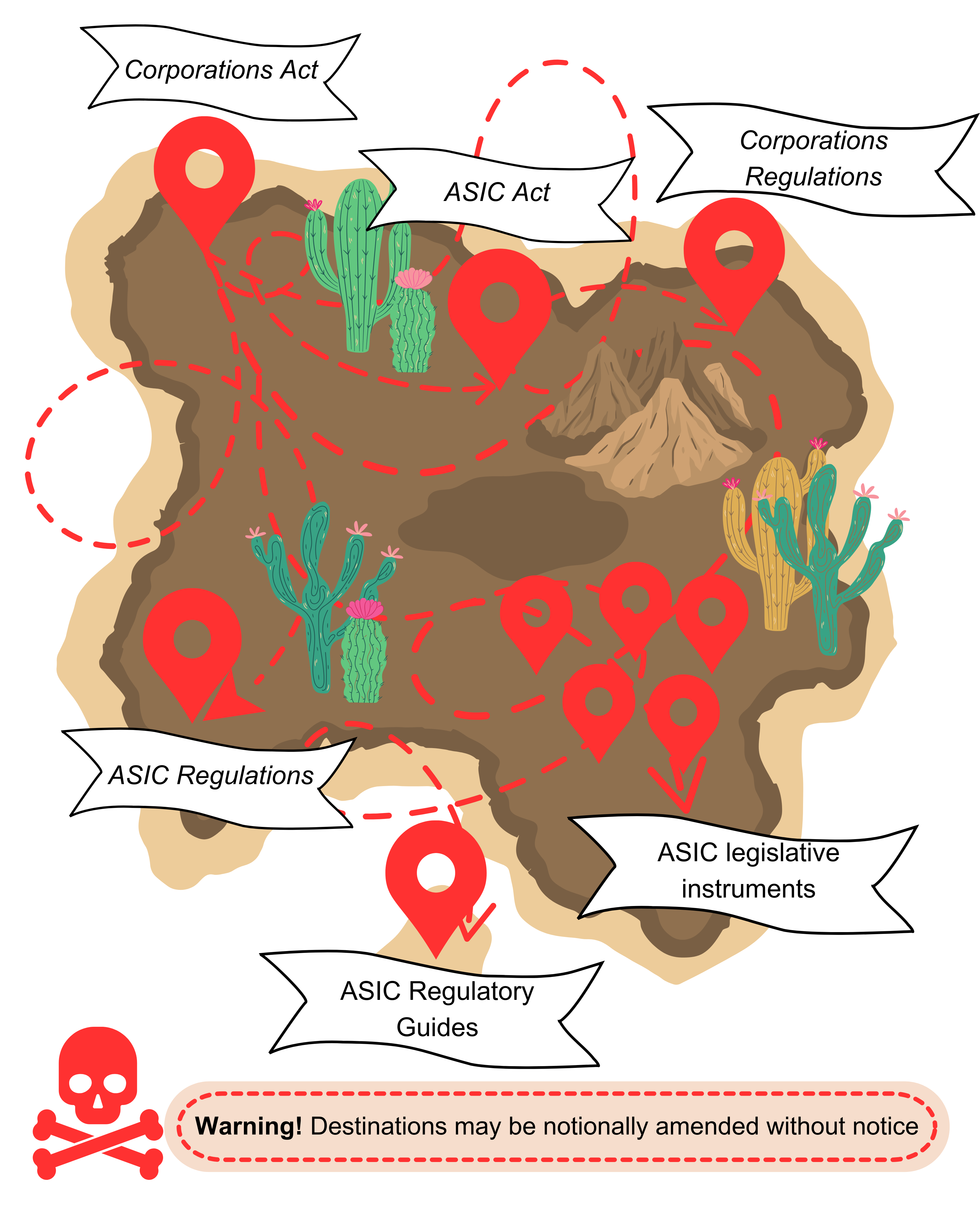

Currently, if a person wants to use financial services legislation, they must wade their way through voluminous Acts, regulations, legislative instruments, and guides, with little indication as to what they can expect to find and where. Navigating the existing legislative framework is a bit like using a treasure map that has many paths, but no clear destination:

The reformed legislative framework

If implemented, the ALRC’s recommendations would transform the existing legislative framework into the reformed legislative framework.

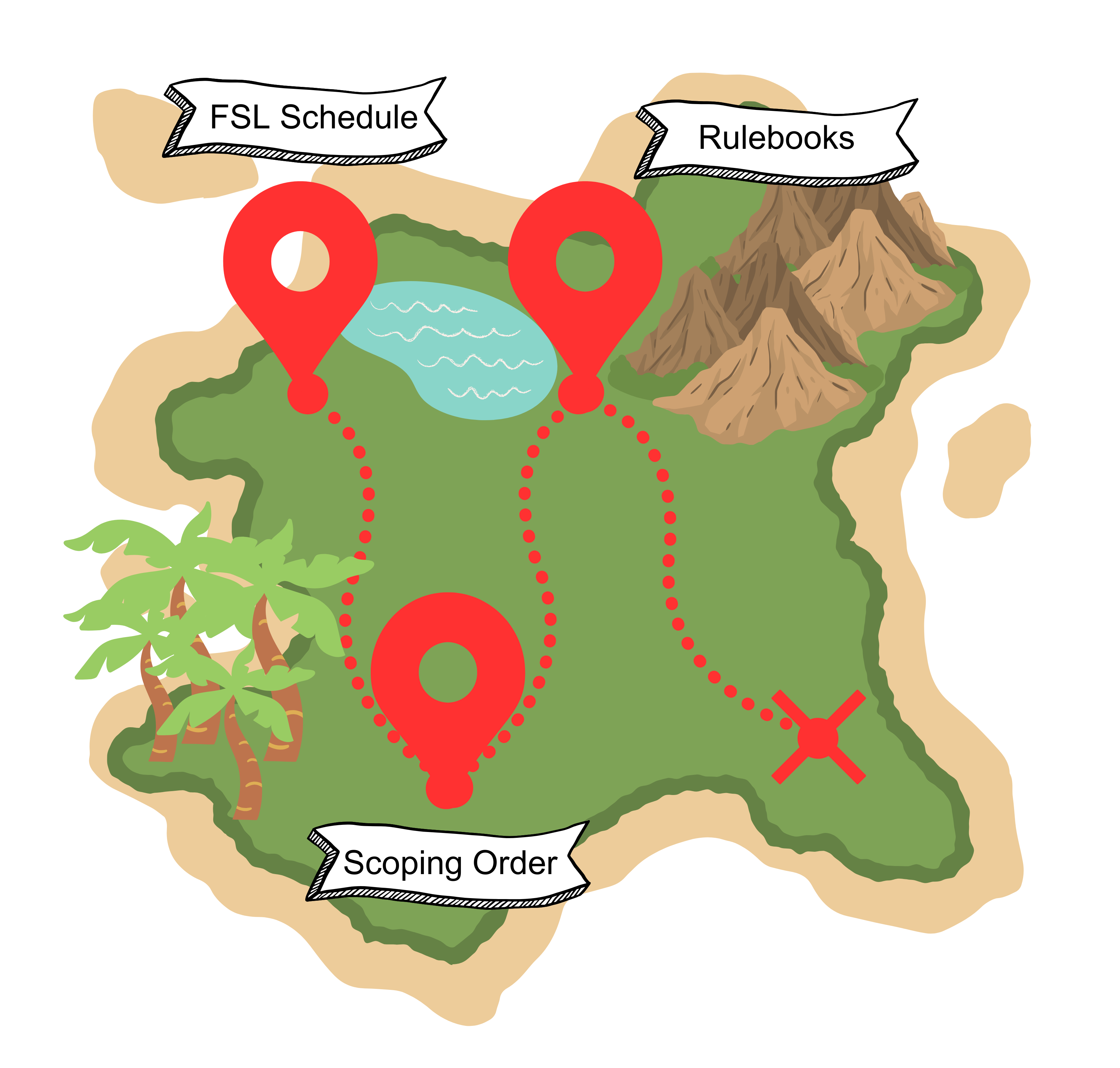

The reformed legislative framework is intended to be clear, user-friendly, and easy to navigate:

- Users would start with the Financial Services Law Schedule (‘FSL Schedule’), where they would find key provisions including important obligations, prohibitions, offences, and penalties. The FSL Schedule would be enacted by Parliament, reflecting the significance of its contents.

- Users would then move to the single, consolidated Scoping Order. In the Scoping Order, users would find provisions that set the scope of the regulatory framework, such as exclusions.

- Users would then move to thematic Rulebooks, where they would find prescriptive detail about how to comply with obligations in the FSL Schedule.

Compared to the existing legislative framework, users would end their journey (where ‘x’ marks the spot) having followed a clearly defined path and without the need to consider whether any part of the law has been notionally amended by another piece legislation. Because the reformed legislative framework would be simple to navigate, it would also be easier for users to develop a clear understanding of their obligations or rights.

Each element of the reformed legislative framework is based on working principles for legislative design set out in the Final Report, all of which help to make the framework easier to navigate and understand:

Each element of the reformed legislative framework is based on working principles for legislative design set out in the Final Report, all of which help to make the framework easier to navigate and understand:

- coherence;

- grouping thematically related provisions;

- intuitive flow;

- prioritisation;

- succinctness;

- consolidating similar provisions; and

- mental models.

Though directed at the legislation that governs financial services, the principles that underpin the reformed legislative framework could be applied to other legislation (especially complex legislation).

For more information, see the Final Report:

- Chapter 3 gives an overview of the reformed legislative framework;

- Chapter 4 discusses the ALRC’s working principles for legislative design that underpin the reformed legislative framework; and

- Chapters 5 and 6 set out the elements of the reformed legislative framework in more detail, discussing how the primary legislation should be restructured and reframed (Chapter 5) and make better use of the legislative hierarchy (Chapter 6).